Prime Minister of Japan weighs market repercussions in selection of next BoJ governor

Market Summary

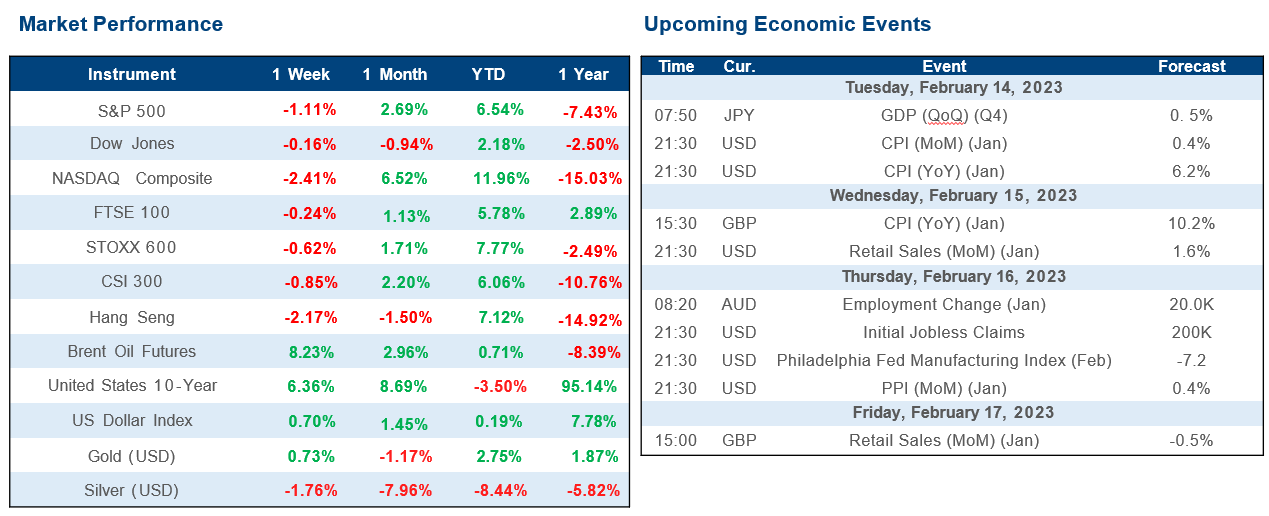

Last week, investors' attention was directed towards the major indexes in the US, which saw a decline due to worries about a lack of strong factors influencing sentiment. Shares in Europe also weakened due to fears of a prolonged recession. Meanwhile, in China, stocks dropped because of the spy balloon controversy.

In the US, major benchmarks ended lower. Alphabet's shares dropped 10% in market value in the US due to inaccurate information shared by Google's AI chatbot, Bard. Europe's market decline was due to concerns over the central bank's aggressive policies prolonging the economic slump. The UK narrowly avoided a recession in 2022, as GDP remained flat in Q4 despite a contraction in December due to various one-off factors such as strikes and decreased visits to healthcare facilities.

In Asia, Japan’s stock markets rose over the week, with the yen strengthening to about JPY 130.5 against the U.S. dollar, from around JPY 131.2 the previous week. Investors are observing the Bank of Japan for potential changes in monetary policy as the end of Governor Kuroda's term approaches. Chinese stocks declined due to the spy balloon incident, and tensions with the US, offsetting hopes for faster economic growth post-pandemic controls. Investor caution towards China's outlook has risen due to decreasing export demand and a weak property market.

Major News

Earthquakes in Turkey and Syria have caused thousands of casualties and rescue efforts are being hindered by the large affected area, poor road conditions, and complex terrain.

Microsoft, Baidu, and Alphabet are competing to offer AI-powered search services with chatbots to transform internet search and potentially disrupt the search industry.

Ukraine and other countries are utilizing AI-powered drone interceptors to defend against enemy drone attacks, potentially revolutionizing aerial warfare and minimizing human involvement.

Gautam Adani's rapid downfall as the world's third-richest man raises questions about his vast ambitions and is a stern test for Indian capitalism.

What Caught Our Attention

Major oil companies, including American and European supermajors, are increasingly looking towards South America and Africa for investment.

The shift towards the Americas and Africa is driven by the potential for both conventional and alternative energy sources as well as environmental and policy factors. The US supermajors are retreating from frontier areas that lack the infrastructure to transport hydrocarbons in an environmentally friendly manner.

The realignment of the oil business along longitudes will have significant implications for the global energy landscape, changing the balance of power and influence with the potential shift towards Americas and Africa as the new centers of production and consumption, impacting the oil market, energy prices, environment, and energy security.

Source: Kredens Capital, T. Rowe Price, Bloomberg, Financial Times, Wall Street Journal, The Economist, Nikkei Asia