Strong economic data boost China’s stock market

Market Summary

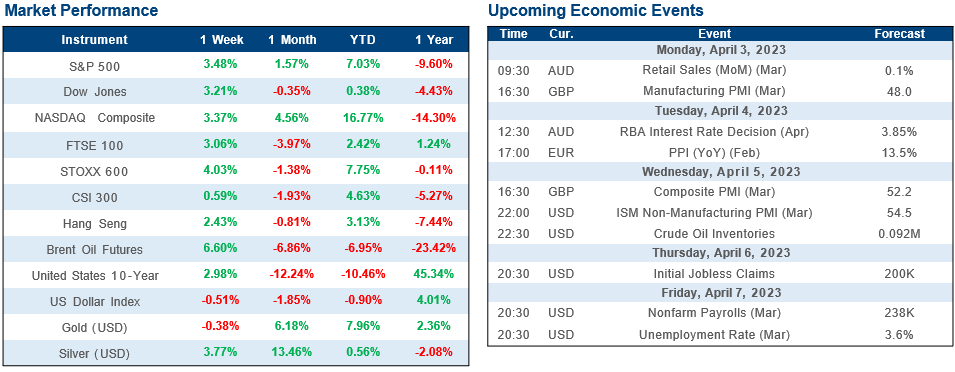

Last week, investors focused on US bank stocks performance and China’s commitment to open its economy.

In the United States, bank stocks advanced. The U.S. core (excluding food and energy) personal consumption expenditure (PCE) price index for February coming in at 4.6%. U.S. Treasury yields increased. In Europe, government bonds broadly climbed. Annual consumer price growth in the euro area slowed to 6.9% in March from 8.5% in February. UK avoided a recession last year, gross domestic product in the fourth quarter grew 0.1% sequentially and shrank by only 0.1% in the third quarter.

In Asia, Japan’s stock markets rose over the week. Core consumer price inflation in the Tokyo area came in ahead of expectations at 3.2% year on year. The yen weakened to about JPY 133.1 against the U.S. dollar from around JPY 130.7 the prior week. Japan’s government announced plans to restrict semiconductor-related exports. Chinese stocks advanced. Premier Li Qiang reinforced China’s commitment to open its economy and deliver reforms that can stimulate consumption and international business. China’s official manufacturing PMI rose to a better-than-expected 51.9 in March.

Major News

Donald Trump to surrender to New York prosecutors on Tuesday.

UK strikes agreement to join Asia-Pacific trade bloc and will be the first country to join the CPTPP since the group was established in 2018.

Chinese e-commerce giant Alibaba Group announced a plan to break itself up into six units.

Italy temporarily bans ChatGPT over privacy concerns.

What Caught Our Attention

US sanctions on Chinese semiconductor firms are disrupting the tech industry in China. Firms are resorting to alternative means of obtaining essential goods due to the ban on the sale of certain semiconductors and related equipment to Chinese entities.

Yangtze Memory Technologies Corp is unable to procure the gear it needs to make advanced chips, leading to the suspension of its 2023 business plan. The sanctions are expected to set back China's chip industry, with estimates suggesting that Chinese firms will only produce 33% of the chips their country needs by 2030. US policymakers aim to limit China's capabilities in "foundational technologies" such as AI, biotech, and clean energy to maintain an edge in these fields.

Source: Kredens Capital, T. Rowe Price, Bloomberg, Financial Times, Wall Street Journal, The Economist, Nikkei Asia